Deadweight loss and Internet 3.0

Could the deplatforming of internet 2.0 happen much sooner than we predict?

As with the last few posts, the TLDR is at the end of the post.

—

This post is inspired by this tweet from earlier this week:

If you have been following tech news in the last 2 years, you’d notice a growing public antipathy to managed marketplaces and centralized platforms. Quite contrary to the love and high NPS they got 10 years ago when the mobile app and digital commerce ecosystem was taking off. Some of this antipathy is coming from a macro-level concern about the power these platforms have on our daily lives, but a large majority is coming from frustration with higher prices for customers and lower wages for drivers, delivery partners, app developers, etc.,

The main concern is about pricing: the 20-30% take-rates are seen as a rake too high for the perceived value customers and partners are getting. From the platforms’ standpoint of view, it seems fairly rational. Most of them are just breaking even from all the customer acquisition spend, with most bleeding money still at a company level. Now that the market is saturated, they have network effects, upstart competition is unlikely to happen, they feel it’s their right to charge that take-rate to maintain the platform and reap the previous losses. Furthermore, low-per capita income levels in emerging markets require a higher take-rate to break even, or onerous local regulations and political hostility in states such as California make them do pre-emptive surcharges and offer benefits. Even more pertinent are the supply-side constraints due to labor shortages in the US that are naturally shifting the prices up due to the supply-demand mismatch.

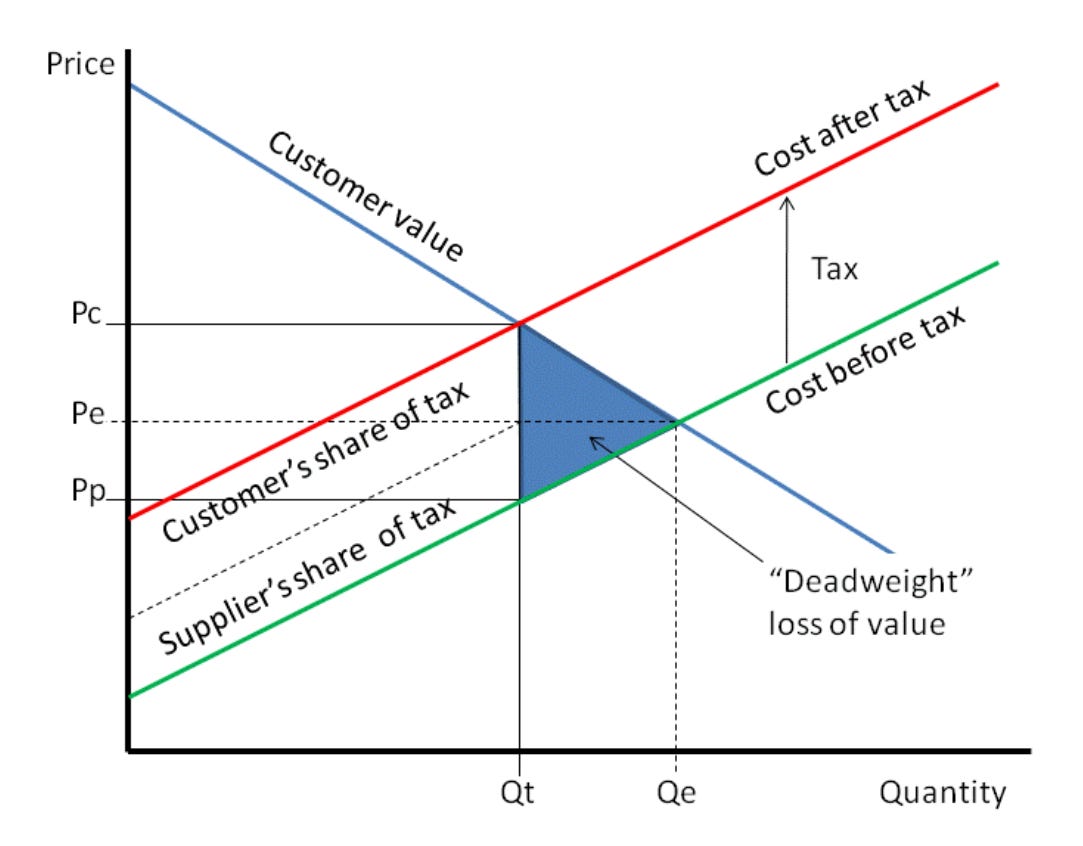

I’m not a trained economist. But from my rudimentary understanding, this is an interesting case study of “deadweight loss from taxation”, with tax, in this case, being the take-rate of platforms. Here’s a good video explaining deadweight loss and the Wikipedia article with a whole section on taxation-related deadweight loss. Here’s the summary image. The relevant takeaway is that because of this tax, some transactions that could have happened in the ecosystem wouldn’t happen as the new price with taxes is above the willingness to pay of those customers, thus creating a loss of economic activity for the whole system, and hence, the term deadweight loss.

Because of Uber’s or a similar platform’s ‘tax’ aka take-rate, it’s either more expensive for customers and/or low wages for delivery partners (driver, developers, suppliers, etc.,). Due to this higher price, some customers don’t avail of that service and take alternatives such as public transport or skip travel altogether and find other activities at home. Thus, creating a deadweight loss.

Don’t get me wrong - taxes are essential. This “deadweight loss” for the system is the surplus for the platform - government, tech company, or otherwise, and it’s this surplus that pays to ensure trust and safety of the ecosystem, by creating ways to pay and settle goods/services and setting incentives and penalties for people’s good or bad behavior.

However, if you look at the economic history of developed countries or this world in general, progress has been made by reducing these deadweight losses. Often, this progress came from three types of sources:

regulatory progress - reducing a non-monetary tax/friction - to enhance economic activity. Like how the Indian govt created a single tax system (GST) across the country removing barriers to inter-state trade and traffic

technological progress - the acceleration of computing power (Moore’s law), internet connectivity, mobile phone-enabled location, payment, and messaging trifecta, cloud and saas ecosystems, and now blockchain/cryptography.

consumer demand shifts - a movement towards sustainable, ethical, and progressive choices; or a willingness to pay for convenience as the money value of time and tasks changes with rising incomes

Or more simply put, in Jeff Bezos’s words, “Your margin is my opportunity”.

But the markets are quite efficient. There are always ambitious entrepreneurs who will break into a sub-optimal equilibrium and move the market forward to a better equilibrium. (Unless there is collusion or entry barriers in the form of regulations or high capital costs, which is why good governance is important for moving economies forward).

Further, I strongly believe that when change happens in one of the three vectors above, the opportunity is time-sensitive. If you don’t move quickly, someone else will, and they will create a new equilibrium with moats around them. This is even more pertinent when the change happens in 2 or all 3 of these vectors; case in point being uber’s rise in 2010s with the mobile internet and app store ecosystem taking off on the technology vector, and comfort with the gig economy taking off on the consumer demand vector. Regulatory hurdles went away after a while and the sector sustained.

This is also my answer for when venture capital is right for a company and when bootstrapping is right. When there’s a time to market pressure, you need those resources to do a land grab on market share. If not, your competitor would and win. Especially in the winner takes all/most markets. When there is no such pressure, you can patiently build the business and figure out vectors to ride.

—

So, coming back to the premise, how could Uber be disrupted in this era? Is there a shift in any of these three vectors that would accelerate their disruption?

I believe there is, and here’s my case for it.

Consumer demand: People are quite comfortable with the gig economy now without a platform in between. Users across the world are used to getting their food delivered, driven somewhere, or buying from strangers without the trust and brand halo from a platform. The local governments and police force also have processes and systems to protect both sides now - It’s not like 10 years ago when the burden of protection was a lot more on platforms than our governments and society. e.g., a theft or a crime in an uber used to be a national news story or social media sensation; now it’s not even covered by the media and local police systems have processes to deal with those issues.

Regulatory advances: This is an accelerant because governments want better outcomes for customers and suppliers. Lower take-rates by platforms get everyone to the desired outcomes than new and non-market friendly regulations. The incremental public taxes could come from lower take-rate taxes of platforms.

Technological advances: Blockchain is the obvious answer that people pitch for a use case like this. There are concerns about the current crypto solutions’ scalability. However, I take a more meta approach. We need a payment infrastructure that doesn’t need to be cryptocurrency - It could be the UPI in India, PIX in Brazil, or maybe CashApp/Venmo in the US - all with wide acceptance on mobile phones.

But trust and safety are where we need the tech and ecosystem to develop further. We need a system where bad actors get kicked off the ecosystem or penalized. We also need a “temporary escrow account” where funds from users are parked until the service/goods are delivered. Furthermore, we need a platform that does pricing accurately, and the platform won’t take off if the prices on this platform are higher than other platforms. This is where blockchain could help. However, given the concerns on today’s ETH and other crypto tech’s scalability, it could be an ecosystem such as Shopify that could do this. The new company could take a fixed charge for every transaction than a take-rate. A new line of tech called “trust and pricing as a service (TPaaS)" could lead this wave.

So, the key here is on the TPaaS solution being built and scaled. I am hopeful that it could be built - more from supply-side than demand-side this time around. Most drivers and supply side have other apps helping them navigate to the customer’s address (e.g., best gates of apt complexes to deliver food, best spots to park, etc.,) or make more money by comparing multiple platforms. It snowballs into scale if there’s a way where these platforms have that supply-unifying app AND not be kicked off the platform for disintermediation (maybe a regulation by a city govt could kick this off!)

It may be tough to create this first for mobility. But it could be done for other managed marketplace use cases. Maybe food delivery, with toast and square terminals powering their terminals to accept delivery orders from customers online and assigning it to a gig worker! Like how Shopify is creating an alternative to Amazon and Walmart. Over time, that solution could then be scaled/adapted to these use cases.

I strongly believe that the arc of progress is leaning towards ownership of outcomes. GenZ and millennials care a lot about this. As with many things, someone on Twitter put it very elegantly:

Internet 1.0 was about organizing the world’s information

Internet 2.0 has been about commerce on the internet

Internet 3.0 will be about ownership of the progress

This generation’s fresh graduates and people leaving their big tech careers have climate and crypto as the two top areas of aspirational career paths. When enough smart people work on a problem, barriers get broken and progress will be made. That’s how history has been made for centuries. Hence, I think it’s not a question about when will uber and other internet 2.0 companies are disrupted, but about how quickly and who.

—

TLDR:

The love for internet 2.0 platforms has waned away and users, suppliers, and governments want a newer equilibrium. Internet 3.0 is about ownership of outcomes as GenZ and millennials and governments want more power to people than platforms.

Today’s take-rate is high, and it has been required to pay for reconciliation, trust, and safety functions. But supply and demand developed the behavior and don’t need as much handholding and guidance on good/bad behaviors.

A new equilibrium is possible if tech could offer these pricing, reconciliation, and safety as a service at a lower cost but with the same reliability. Blockchain and crypto are the lead contenders, but Shopify-seque platforms could also be intermediate solutions if the right team and local market/regulatory conditions come together.

—

Post-script: This marks the completion of my goal to write every 2 weeks for three months - the goal I set in the first post in June. As I reflect, this has exceeded my objectives by a large margin - I didn’t expect thousands of views and several people reaching out with resonating thoughts, feedbacks, and words of thanks. Even more pleasantly surprising is to wake up yesterday to see one of my blogposts translated to Portuguese by someone who came across it - and now that post is more popular than my original post, with users posting resonating thoughts on Linkedin. Love it!

However, it takes a lot of effort to do this on weekends, especially after long work hours in the middle of a pandemic! It generally took me at least 6-8 hours to think, research, and write; and I had to send it in advance to friends for review so I don’t hit any PR landmines inadvertently.

So, as a middle ground, I’m going to continue this new habit but with one minor tweak. I will commit to publishing at least once every month, but I will still try to do it every 2 weeks. I will do this new cadence for the next 6 months and reassess as I’ve done now.

Thank you all again for your feedback, support, and attention! Have a good weekend!!

I always used to think that Uber can be disrupted by Shopify-esque startup - despite the network effects. Good to see you think the same.

In Goa, the government has banned ola/uber and given a different natively developed app to taxi drivers. It's clunky, has limited features but does the job. And I am sure the drivers are happy when they get to keep all of their earnings.